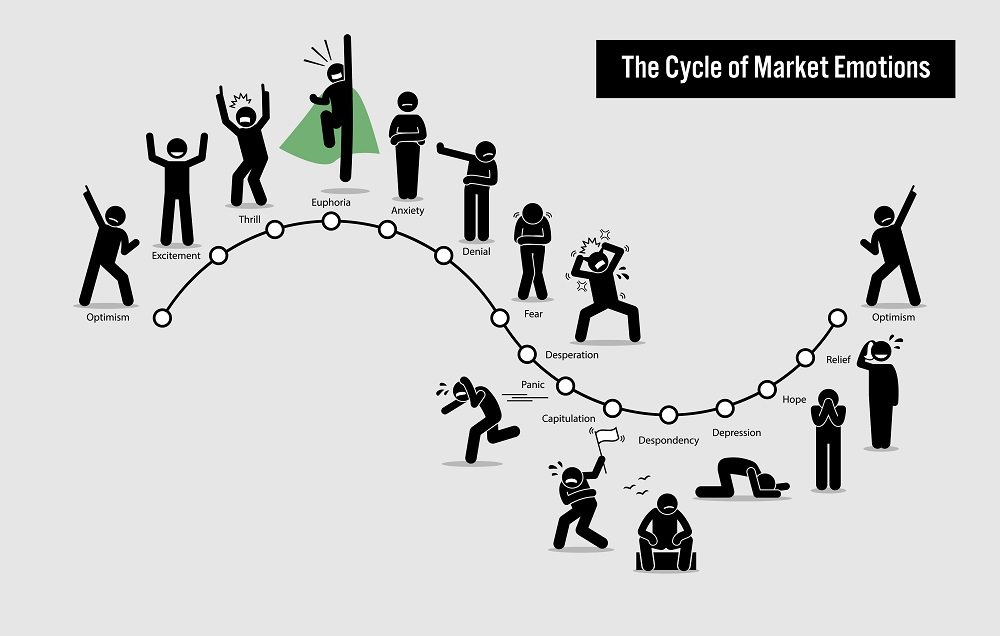

The Cycle of Market Emotions

The Stock Market is cyclical. We are humans with emotions. Combining the two results in an observable boom and bust of wild but predictable emotions.

In this article I will go over all the emotions that you will witness (or experience!) during the Stock Market’s various phases. By understanding the natural ebb and flow of the boom-and-bust cycle it may help you identify where we are now in the cycle.

Accurately gauging market sentiment and what it may mean for the future could be useful. If you were aware of the euphoric nature of the market back in 1999, would you have still invested? Would you have been better off on the sidelines?

Some of the examples are a little visceral, but trust me when I say they can be very real for many people who get in a little above their heads.

In this Article

Phase 1: Optimism

There is no beginning or ending to an ongoing process that peaks and troughs routinely… but starting at the optimism stage is about as good as any.

There is no beginning or ending to an ongoing process that peaks and troughs routinely… but starting at the optimism stage is about as good as any.

At this stage, the Stock Market is chugging along… it hasn’t created any type of stellar return but is off nicely from its previous march lower during the last recession. At this stage, things feel good, and the future looks bright.

Phase 2: Excitement

During the excitement phase your earlier optimism has turned into tangible market gains. Investments you had made that you thought had a good chance to do well have done better than expected.

At this stage you your excitement and risk level are increasing. New technologies and products seem to make once boring companies more interesting. Most of the market is moving up in tandem meaning the chance of making a misstep is unlikely.

Phase 3: Thrill

During the thrill phase of the market, you are beating the long-term averages for stock market returns. When you check your brokerage account before and after restroom breaks you have made even more money.

Updated calculations of when you can retire get sooner by the second. The thought of quitting your job and trading stocks online becomes a serious dinner conversation with your spouse. Instead of just buying ETFs and the occasional individual stock you have moved into options.

You buy Calls and Puts on high beta stocks when you are feeling froggy… everything else is borrowed using margin.

Phase 4: Euphoria

Exceptional ongoing returns have made you numb to reality. The only thing you know is that the power of compounding interest is going to make you a millionaire billionaire. The value of your house has skyrocketed, and you have found great ways to invest the money you got back during your last cash out refi.

During this part of the market cycle, there is chatter abound about being in a bubble… but it doesn’t matter. Prices only go up. Period. This is the new normal. The stock market couldn’t possibly go down unless people like you sell their positions… and you won’t sell.

Phase 5: Anxiety

Cracks have started to appear. Selloffs in various parts of the market have started to crush some investors despite the broad indexes powering slightly higher on a few names. Stories about individuals losing significant sums from margin calls are cropping up in your news feed.

Increasing choppiness in your own portfolio has you on guard. Attempts to sell at the price you want has been difficult. You become worried that your leveraged positions may sting if the selloffs reach your corner of the investment world.

Phase 6: Denial

The nightly news has started making events in the stock market the first story each night. Major companies who seemed promising just a short time ago have begun defaulting on debt and there is even word that a few may go bankrupt taking their shareholders with them.

But you have been successful at this stock picking thing. The losses in your account can always be won back. You start to believe what you want to believe… that this is temporary and if you just block all the noise out you will come out the other end unscathed.

Phase 7: Fear

One of your brokerage accounts was issued a margin call one Friday afternoon. You thought it might happen, but it occurred so much quicker than you were expecting. Luckily you had sold some stocks in another account ahead of time to shore things up.

But you start to realize that you can’t do that in all your accounts. If you sold all your positions now you would be down substantially from where you began. Most of that money from the home refinance is tied up and your spouse is only faintly aware of the situation.

Phase 8: Desperation

You had a sit down with your spouse about your finances.

They are scared. They want you to figure this out and get your money back. You need it for retirement. You had already started taking a back seat at work so you could focus on trading… you were passed up for the promotion you had been working for and this money in the Stock Market is all you got.

You start making phone calls.

Attempts to refinance your home again fails. The value has gone down since you last refinanced. Unsecured loans at high interest rates seem to be the only option… but you are worried they won’t be enough to plug the gaps.

Phase 9: Capitulation

You’ve vowed to never trade again. You start unwinding all your leveraged positions at massive losses. You call the cable company and cancel HBO. You start talking to your spouse about getting a part time gig as a bouncer at the local watering hole.

It was good while it lasted, but it’s over now and time to accept that fact. You just want the pain stop. You don’t want to see any more brokerage account statements. You deleted your spreadsheets for tracking profits… there aren’t any anymore.

Phase 10: Despondency

It starts to occur to you that you may never retire.

You may end dying in your cubicle… after-all you’ve needed to work longer hours than ever before just to keep your job. Your company is doing about as bad financially as you are… layoffs have sprung up periodically unannounced.

The only thing you can do to get away from it all is eat your emotions. You’re gaining weight and you don’t even have the money in your checking account to pay for a gym membership… all that went to the bank to close out your 2nd mortgage. You had to close it since you have placed your home up for sale due to the need to downsize.

Phase 11: Depression

You haven’t checked any of your accounts in a while. Its totally possible they could be negative… or even up… neither one would surprise you at this point. You’ve heard word that some of the government relief programs are starting to show some promise… but that won’t help you. It’s too late.

The stock market seems to be bouncing a little upward… but who cares. There is no way you will get to where you were at just a short time ago.

Phase 12: Hope

It turns out, that in all the hoopla of euphoria of the market, you didn’t realize you still had a 401k from a previous employer (a common occurrence believe it or not!). The returns aren’t great but well above the market bottom.

After running a few numbers, you realize that retirement might still be possible… maybe with a part time job. You start thinking about saving some money again in a broad index fund.

Phase 13: Relief

Several beaten down stocks have made recent rallies. Value investors and companies with strong balance sheets have been acquiring high quality assets at discount prices… including some of the companies you have stock in.

The rally in prices isn’t Earth shattering, but it’s enough. Spending time with your grandkids has given you newfound joy and the thought that you aren’t completely broke makes you smile occassionally.

Phase 14: The Return to Optimism

Over the last several years, your decision to start placing money into retirement accounts again is starting to pay off. Compounding returns have left you feeling that you may be able to ditch that part time job in retirement if you can just get a few breaks. Afterall you’ve gotten a few already in the last few months.

Once again, looking at your account statements feels good, and the future seems bright. The cycle starts over.

Summary

If you can glean anything from this article, I hope it is that the more interaction you have with your investments the likelihood that you may go mad in the process (and broke) goes up. Have a smart and diversified plan that you stick to. Don’t leverage your capital in good times and liquidate in bad times. This will lead to less stress and more profit.

The market moves in cycles.

You can get burned on both ends. The chances that you will be able to discern the best timing to enter and exit a market is nearly impossible. However, staying away from leveraged assets will help you steer clear of margin calls and other nasty investing related events that can wipe you completely out.

I hope you enjoyed this article. Writing this article was a bit eye opening for me… it always makes me anxious to think about where we are currently in the market cycle. I had to quickly snap out of it and realize I have no idea where we are in the cycle… if you have any thoughts then throw down in the comments below.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.