The Stock Market is Way Up… Should I Sell

Table of Contents

If you are concerned about the direction of the Market for no other reason than where the Market has been recently, then you should not sell. In this article, I will go over several reasons that underscore how its possible to sabotage your future returns by getting out of the market.

The answer to whether you should be in the Stock Market at all comes down to what your time horizon and risk tolerance are. Whether the Stock Market has reached recent or all-time highs is not part of that analysis.

The Stock Market is Not a Zero-Sum Game

One of the most helpful realizations I have come across over the years is simply this: the Stock Market is not a Zero-Sum Game. If the market is up today it doesn’t not need to be down tomorrow to reach some type of balance.

It is possible, and likely, that the market will be up in the short, medium, and long terms all at once. It does not mean that it will ‘need’ to be down during the next period.

In a Zero-Sum game, whatever is gained in one area must be lost in another area. In the Stock Market, Compound Interest is the rule… not Zero-Sum. Compounding Interest implies that over time, gains will be made on top of gains.

The gains in Compounding Interest are exponential in nature thus looking at a normal graph of returns over a long period may be misleading. Rather, looking at a graph of returns on your chosen investment benchmark such as the S & P 500 on a percentage basis may be more informative.

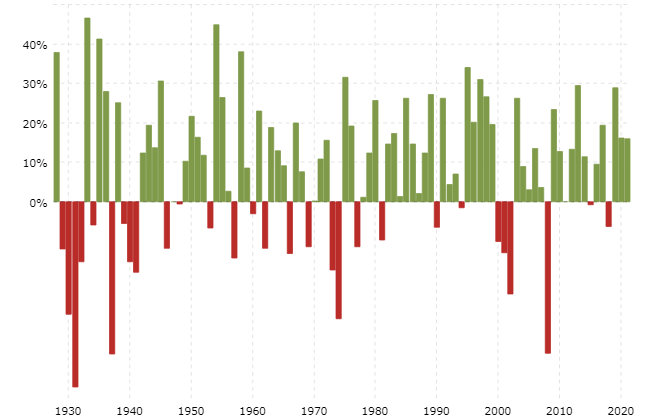

Below is a chart I was able to quickly generate at MacroTrends showing the S & P 500 Returns on an annual percentage basis from 1930 to 2021.

Here are a few key take-aways that I see just from casually looking at the chart:

-

- There are way more years with positive returns than negative

- Over time the frequency of years with negative returns has lowered

- Recent returns don’t seem out of line compared to long term averages

- It would be reasonable to assume the next bar could be green or red

Given no other information except the chart above, would you want to sell your stocks now? Probably not. The limited number of red bars highly outweighs the green bars. It even appears that if we were to suffer a downturn it would likely be followed by a series of green bars. Given a 10+ year time horizon, the things appear rosy according to this chart.

Perhaps the reason you may be even thinking about selling your holdings is because of what you may be hearing from the news, media, your friends, or coworkers. Much of what we are thinking, or feeling is often due to absorbing the information that we indirectly consume without even knowing it.

The ‘Noise’ is What Stresses us Out

Our biological imperative is to respond to a perceived ‘danger’ when we hear negative things about the Stock Market. After all, much of our livelihoods have been tied up in a hard to predict if not impossible instrument of wealth generation (or destruction). Things we may hear include:

-

- “It’s time a for a crash.” This statement is ludicrous in of itself. The market has its cycles of ups and downs, but they are not predictable. It is never time for a crash… or rally. In fact, most market prognosticators who predict crashes have been ‘predicting’ crashes for many years to have only missed out on several years of 20% + returns.

- “The Stock Market is Over-valued based on historical measures.” This may be true at the time of print; however, readers should understand that the traditional measure to determine value is the P/E Ratio (Profit / Earnings). Earnings are released quarterly, and earnings can go up lowering the ratio.

In fact, in January 2021 the Stock Market was considered incredibly expensive. But as the Market rallied over 15% into September of 2021 the P/E ratio dropped (became less expensive) because earnings went up. Below is an excellent chart showing the P/E Ratio for the S & P 500 over the last 150 years.

If you would have sold your stocks based on things being ‘expensive’ in January, you would have missed out on a massive rally that resulted in a cheaper overall market. As you can see the P/E ratio dipped at the very end as the market rallied.

“The Government is printing money, it is worthless.” There is a lot of fearmongering when it comes to how the United States and other countries’ Central Banks manage monetary policy, but don’t this nonsense clog your brain. We are not on the ‘Gold Standard,’ and won’t ever be again.

Even if printing money by the Central Banks results in some mass devaluation of major currencies (also known as hype-inflation) wouldn’t you rather be invested in a company that has customers that pay for its products? To make up for the inflation the company does not necessarily have to let inflation cut into its profits… it can raise prices.

If you are worried about the Government printing money, invest in companies that have Pricing Power over their products… meaning they can increase the price of their products because their customers NEED THEIR PRODUCTS.

- “It’s time a for a crash.” This statement is ludicrous in of itself. The market has its cycles of ups and downs, but they are not predictable. It is never time for a crash… or rally. In fact, most market prognosticators who predict crashes have been ‘predicting’ crashes for many years to have only missed out on several years of 20% + returns.

In a sense, writing this article is therapy for me. I, like you, often wonder if it’s time to sell everything and move to either cash or a safer investment. But I know the truth. I know that my time horizon is long (greater than 10 years) and that selling anything now would be a fool’s errand. But why are my emotions detached from reality?

There is an all-out assault by talking heads on T.V. and the Stock Experts in the cubicles adjacent to yours that wears us down. It is driving you to question the safety of your investments… but rest assured your money is not safe. Wait, did I just say that?

Your investments are Not Safe… but they Never Were

Selling your portfolio after it has had a recent run of good performance would somehow be admitting that portfolio risk is different than at the time of purchase. Selling would mean some other piece of information has come to bear that wasn’t known before.

Ask yourself… what is different now? Are you worried about losing your gains or has something fundamentally changed about the economy that has changed the risk / reward scenario?

Perhaps you aren’t an investor after all, perhaps you are secretly a gambler who is worried about playing a game they do not understand. Understanding what is driving your thought process is necessary to further drive an informed path forward.

The Gambler’s Fallacy

The Gambler’s Fallacy is a way of thinking that leads a person to assume a particular event is more likely to happen based on past events. Does this sound familiar? The canned financial services disclaimer comes to mind almost immediately:

The Gambler’s Fallacy is a way of thinking that leads a person to assume a particular event is more likely to happen based on past events. Does this sound familiar? The canned financial services disclaimer comes to mind almost immediately:

“Past results are no guarantee of future performance.”

To cover their hind quarters, financial companies who make a living on giving a financial advice must make a statement that directly addresses the Gambler’s Fallacy. Perhaps there is some insight to be gained.

It’s logical to try to build a puzzle based on what the pieces that have already been joined look like. But, if the puzzle is composed of millions or billions of pieces we have to admit that are limited as humans to make an informed guess as to how things will pan out.

The Efficient Market Theory

One truth that I think most people can agree on is that the Stock Market is breathtakingly complex. It is comprised of the decisions and thought processes of ALL its participants… large and small. Legal and illegal. Just and unjust. Smart and dumb.

If your portfolio is built from broad based index funds, then your performance will be a summation of all its components. The Efficient Market Theory states that any share price reflects all information available to participants.

Thus, whatever your portfolio is worth right now is theoretically the price it should be based on what everyone knows right now. Thus, unless you have a crystal ball (please email me if you do), then there is not a high likelihood of you knowing something that the rest of market does not.

Here is a quick YouTube video that gives an excellent overview of the Efficient Market Hypothesis:

Holding on to your investments in this case would be the best idea… after all, given this theory your portfolio should be priced. Any move up or down would be based on new information that you just do not have yet.

Taxes

Taxes is another big factor to consider when thinking about selling your stake in a specific investment when you are using a taxable brokerage account (this does not apply if you are using tax-advantaged retirement accounts such as an IRA or 401k).

If you have held the position for less than a year, then your tax rate could be substantially higher than if you had held it longer than a year.

Additionally, if your overall time horizon is long then you may be considering selling your position now so that you can reenter the market later… but if you must pay taxes now on your earnings and pay taxes a 2nd time after you exit the market later is it really worth any ‘projected’ savings from a market downturn that is highly uncertain anyway? Probably not.

Paying taxes now would mean that you could miss possible market gains and upon reentering the market have less capital due to taxes to earn compounding interest. A triple whammy in my opinion.

As a quick note: taxes are notoriously difficult to give general advice in this article. Additionally, Congress has changed the rules several times in recent years and appears about to do it again. Here is a link to a Capital Gains Tax Rate Calculator from NerdWallet that is kept up to date.

When you consider your tax situation, it is always prudent to talk to an accountant. At a minimum, ensure that you are using up to date information as things change rapidly based on local, state and national political policies.

Concluding Thoughts

You should not move into and out of investments based on what you hear on Television, at work or how your emotions make you feel. As I have shown in this article, we as humans are incredibly prone to making decisions that are not based on reality. We can not know the future based on what has happened in the past.

What we can glean from long term stock performance is that the market generally moves up. To take a position against this long-term momentum is likely flawed. Economists theorize the market is efficient and whatever price we currently hold our securities at is likely a fair price for the asset.

It is highly possible the market may plunge at any time, but again as we have seen even as recent as 2021, it is possible for historically expensive stocks to go up in price and become ‘cheaper’ at the same time. It would be a shame to miss out on a rally while also having to pay taxes.

If you aren’t ready to use the funds you have invested in your portfolio and your time horizon has not changed drastically, then just hold on to your stocks… they may go up or down in the short term but over the long term they will most certainly be up.

Financial Disclaimer

I thoroughly enjoy writing for this blog but please understand that the content presented represents my opinion only. You should not interpret what I have written here as financial or investment advice.

Seek consultation from a Financial or Investment advisor that has your best interests at heart (fiduciary responsibility) and do your own research before making any decisions that affect YOUR money. As always, comments are welcome… put them below or shoot me an email!

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.