Should I Pay Off my Mortgage Early?

Table of Contents

Should you pay off your mortgage early? The answer is, “it depends.” In this article we will look at both sides of the mathematical and emotional aspects of paying off your home. More than likely, the math aspect will tell us ‘no, do not pay off your mortgage early,” while the emotional aspect will tell us to, “pay it off as quickly as possible.”

The answer for you is probably somewhere in between.

The Math Answer: Interest Rates

The mathematical argument to pay off your home mortgage or not is very simple. It can be distilled into a single question:

Can you earn a higher interest rate than what you are paying in interest on your mortgage?

If the answer is ‘yes‘ then it does not make sense to pay off your mortgage. Why would you in this case? As an example, if you can earn 8% per year over a long period of time in the Stock Market, it doesn’t make sense to pay down a mortgage that is only costing you 3.5% per year.

If the answer is ‘yes‘ then it does not make sense to pay off your mortgage. Why would you in this case? As an example, if you can earn 8% per year over a long period of time in the Stock Market, it doesn’t make sense to pay down a mortgage that is only costing you 3.5% per year.

If they answer is ‘no‘ then it does make sense to pay off your mortgage or even to refinance your mortgage to a lower rate (refinancing would require an accounting of the fees charged in the transaction as well to determine if it made sense).

The difference in interest rates is key. If you can earn the same amount on the open market in interest as you are paying for your mortgage, then it’s a wash. It, mathematically, does not matter which one you choose.

But how do I know what I can earn in interest? The answer to this question depends on your time horizon and what level of risk you are willing to take on. Back in 1990, it wasn’t uncommon to find Certificate of Deposits that paid as high as 8%! However, the average mortgage rate was over 10%.

Thus, although you could make what would feel like an incredible amount of interest on a low-risk investment, the rate you would need to make it worth not paying off your mortgage was even higher. In other words, to get a rate high enough to make it worth your time you will need to take on some additional risk.

To get a high enough interest rate to beat out your mortgage rate, you will likely need to invest in bonds and / or the stock market. For stocks, the Combined Annual Growth Rate (CAGR) has been 12.01% from 1980 to 2020 (average annual growth was 13.33%, but this number is irrelevant for many reasons we won’t discuss here).

Keep in mind the CAGR value I quoted does not consider inflation because your mortgage rate doesn’t go up with inflation. You can calculate this value yourself here.

With an expectation of earning 12.01% over a long period of time, we can then justly assume that if our mortgage interest rate is below 12.01% (I sure hope so!) that we are better off mathematically to pay off our home mortgages as slowly as possible.

The Math Answer: Compounding Interest

Let’s run a few numbers now to see how this theory stacks up. Assume that as shown above, we can roughly expect a 12% return on money invested in stocks (without inflation) and that our mortgage interest rate is 4.5% (this is conservative in today’s environment).

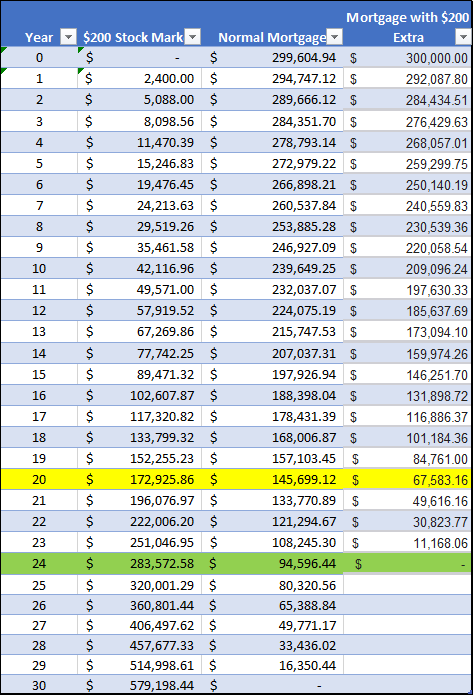

What if we decided to pay an extra $200 a month towards our mortgage compared to investing $200 in the stock market… how would this pan out? Also assume a mortgage of $300,000 amortized over 30 years.

As you can see in the chart above, after 24 years of paying an additional $200 per month you will have paid off your mortgage 7 Years earlier. If you would have invested it you would have made $283,572.58.

Additionally, if you would have invested the money at year 20 you could have just paid off the remaining balance of the mortgage. At year 20 you would have amassed $172,925.86 but only had a mortgage of $145,699.12. By investing the $200 per month you could have theoretically paid off your mortgage 4 years sooner than paying the mortgage off directly!

Ideally, however, in this scenario it never makes sense to pay off your mortgage early. If you go on to pay off your mortgage as slowly as possible you could end up with about $580,000 and a paid off house albeit it would take 30 years. But the relies heavily on being disciplined about saving each month and not touching the principal over a very long period.

The Emotional Answer: Debt Anxiety

The idea that we could own our own home outright is a big one. So is the stress of having to make a house payment. What if we lose our job and can no longer pay? What if we are injured or something happens to us? Will the bank take our house away from our family?

The idea that we could own our own home outright is a big one. So is the stress of having to make a house payment. What if we lose our job and can no longer pay? What if we are injured or something happens to us? Will the bank take our house away from our family?

These are all important questions that help drive a different answer when it comes to paying off your mortgage early. Anxiety about debt and the ‘what ifs’ of life could be significant enough that making the best mathematical decision isn’t the best decision.

This is where you will need to get in touch with your feelings. How much anxiety does having to pay your mortgage each month cause you?

For me it’s not much. I know that the money I save in lieu of paying off my mortgage is safe in an account that I do not spend for any reason… I’m retired and can’t lose my job because I don’t have one. But this may not be your situation. Everyone has specific and unique considerations.

This is what it means to answer the payoff question based on an emotional answer.

It is perfectly legitimate to pay off your mortgage if it makes you happier! As I bring up time and again in this blog… money is not happiness, but it can help us make choices that lead to a happier life. If paying off your mortgage now makes you happier now, then you should do that versus waiting to have more money later.

The Emotional Answer: Discipline to Save

But what if you decide that you won’t be happier if you pay off your mortgage now? What if debt anxiety isn’t an issue for you? What are other factors that involve emotions that could force your hand over math’s natural advantage?

Discipline.

The discipline to take the extra amount that you would use to pay off your mortgage each month and put it into an investment vehicle and then not touch those investments for long periods of time take a lot of discipline.

Do you have the discipline to have potentially hundreds of thousands of dollars in your account and not touch it over decades? Many do not. You need to ask this of yourself to determine if paying into an investment account trumps paying off your mortgage.

Define your end state and ask yourself if you have the will power to get there without sabotaging yourself. The only right answer to this question is the one that is truthful to yourself.

Combining Math & Emotion

So far, we have only considered the extremes of the situation: to pay off or not pay off… but is that actually the question? What if we do both. In the above scenario we had used $200 to either help pay down our mortgage or invest in the stock market. But if after trying to determine the proper path forward we are still stuck we can just do both.

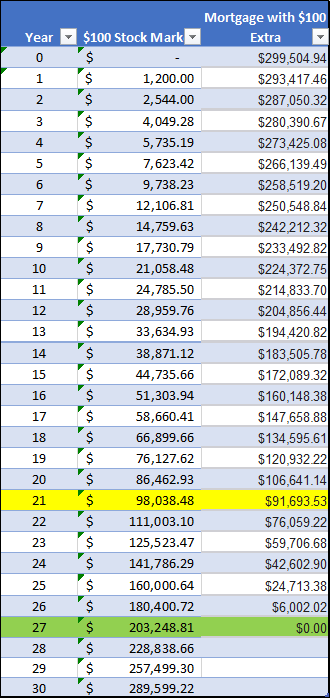

In other words: identify the amount that could be used to pay off our mortgage or invest and just put half towards both. If we determine in the future that we have a better way of doing things we can always adjust at that time. But as an initial thought experiment cutting it down the middle is a good approach. Let’s look at how the numbers would stack up.

By attempting to thread the needle it looks like we could pay off our mortgage 4 years early (instead of 7) and have over $200,000 in the bank. Alternatively, we could take the amount we invested in year 21 and just payoff the mortgage… a 9-year savings. This is only 1 year off our above chart where we invested everything.

Cutting our extra amount each month in half and ‘hedging‘ our bets is a solid choice if you are not persuaded to choose one extreme or the other.

What if I have a Lump Sum?

If you are fortunate enough to have a lump sum versus a monthly budgeted amount that will be going either towards investments or your mortgage, then the calculations are basically the same.

If the interest rate on your investments is reasonably expected to outperform the interest you pay on your mortgage, then the ‘math answer‘ is to not pay off your mortgage early. The interest rate disparity is again the deciding factor for a purely quantitative comparison.

A note About Taxes

I want to address taxes really quick… you should definitely read up on two types of taxes when exploring whether to pay off your mortgage or invest in the stock market. The first type of tax is capital gains tax which would apply to your investments. The second type of tax is the mortgage interest deduction.

Both complicate the mathematical calculation, but, as a rule of thumb, if you are an average household that doesn’t make extravagant amounts of money each year, the role of taxes will not play a major role in the decision you make…. But they will still be different, maybe even considerably so. Talk to a licensed accountant for details and for confirmation, but if you are looking at 5, 6 or 7% between your expected CAGR and your mortgage interest rate then the math should still favor investing your money.

That said, it would be a wise idea to confirm any type of tax burden that you may incur. If you use, for example, your emergency fund to pay off a large part of your mortgage, you may have a higher-than-normal tax burden since you will be paying less mortgage interest. Without an emergency fund, you find yourself suddenly unable to pay this unexpected tax bill… woops!

Alternatively, any gains in your investment account including appreciation and dividends will be taxed at varying times and rates. These rates often change depending on Acts of Congress and thus your tax burden may be different in the future from what you calculate now.

Stay aware of your tax situation during your initial decision and on an ongoing basis as well.

Concluding Thoughts

Paying off a mortgage is a big commitment. Not paying off your mortgage is less of a commitment and a possible opportunity to grow wealth. The choice in of itself is difficult, but the crux of the decision really comes down to what type of anxiety does having a mortgage payment cause you each month. If it’s not a lot, then consider saving that money and investing it.

Just remember that the alternative extreme, paying off your mortgage early, is not necessarily a bad decision either. Just make sure you stay disciplined with any capital gains that are earned with a focus towards your initial goal.

If you find yourself caught between the logical and emotional arguments, then just choose both. Split the amount you had planned to put towards your mortgage, whether a monthly amount or a lump sum, and move on with life. It’s a solid balance between two difficult choices.

I hope you enjoyed this article! love hearing from readers… drop a line below in the comments!

Financial Warning

I’d like to remind you all I write this blog as an expression of my personal opinion. The topics I covered should not be considered investment advice. If you are looking for investment advice you should hire a professional who is paid by you to understand your risk tolerances and investment objectives.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.