How Much Should I Save for Retirement?

Table of Contents

The financial industry is cluttered with products for prospective retirees. But there should be a number, derived from some simple math that should give us an idea of EXCACTLY how much we should be saving to meet our goals. Luckily, with a few assumptions there is.

In this article I’ll show you how to determine two things: the TOTAL amount you need to retire and the MONTHLY amount you need to save to get there. This process isn’t complicated. It will be something that you will want to look at periodically. Your situation will always be changing and updating your assumptions will be necessary.

Retiring Based on Monthly Cash-Flow

Before deciding how much one should save for retirement it’s important to set the goal posts. Defining the structure of how I will approach this will give a framework for repeatability.

In this article I will be basing my calculations off trying to find the amount of money needed per month. How much cash flow is needed to live in retirement?

The cash flow concept is the basis for most budgeting styles. Both personal budgets and corporate financial statements use cash flow. If you are new to personal finance, this may be a bit different than looking at your annual salary vs your monthly budget.

The big take away when using monthly cash flow is that your expenses usually occur monthly. Thus, a useful budget is also usually tracked monthly. This allows you to forecast easily and to account for unexpected spending quickly.

Using a monthly budget against a backdrop of a reoccurring income allows us to come up with our Net Cash Flow. This will be the crux for successful retirement planning.

To calculate your current net monthly cash flow just take all your after-tax income and subtract all of your expenses. Whatever is left is your net monthly cash flow. Ideally, you will have a positive number.

A positive number means you have a little bit of money left over each month. A negative number means that you had to spend money that you didn’t earn in that month. A value of 0 means your budget was ‘perfectly balanced.’

Our goal for retirement is to have about 10% of the monthly budget ‘left over.’ We want to plan to have a little bit left over just in case there are unexpected expenses. We don’t to plan for to save too much because that will impact the quality of life during our working years.

If we plan to save too much then we will work too hard, too long or not spend as much as we could during our working years.

Only you can determine what your retirement budget will look like. Keep in mind that you will want to add in any recreational items that you don’t currently spend money on. You will have a lot of free time after all!

As a rule of thumb, many Financial Advisors recommend you plan to budget 80% of your pre-retirement spending. I don’t agree with this.

Although your expenses may go down for things like transportation, work clothing and other items, you will probably be spending time on the golf course, your boat, or some other activity that will result in a an increase in costs. I would recommend planning to spend at lest 100% of your pre-retirement income on retirement.

Saving 10% of your Income

Many ‘experts,’ including at times Dave Ramsey and others, have recommended saving 10% of your income towards retirement. But is this enough? Let’s look at a hypothetical scenario to find out.

Let’s assume that the average person starts saving for retirement at around the age of 25. Let’s also assume that they will retire around the age of 65. Both these numbers are a tad conservative since an individual could easily start saving earlier and the full retirement age is 67, however its prudent to be slightly cautious.

Now between the ages of 25 and 65 there are 40 years… so that will be the number we will use to compound our savings. One other assumption we will use is that whatever a person was earning at the age of 25 will also be the same amount of buying power at the age of 65. In other words, their income has kept up with inflation.

Now, to set this up, let’s assume the first year, at the age of 25, the income earned is $1. The final calculation will result in a number that is a multiple of 1 and thus a multiple of the original income earned. The formula used to calculate compound interest with monthly contributions is:

A = P*(1+r/n)nt + M*((1 +r/n)nt -1)/(r/n)

Where A is our final amount, M is our monthly 10% contribution, r is our interest rate, n is the number of months in a year and t is the number of years.

We will use an interest rate of 12.01%. Why so high? It is actually the value for the CAGR (Combined Annual Growth Rate) of the overall Stock Market (e.g. VTI) from 1980 to 2020. Past performance can’t predict the future, but it can give us a rule of thumb. We’ll explore lower and possibly more prudent values later.

Alright, plugging the numbers in to my handy Python Compound Interest Calculator we get the following plot:

As you can see above, after 40 years, we should roughly have saved approximately 100 X our initial salary. That’s quite a feat! But what if you can’t count on a 12% return? Many Financial Advisors recommend using only an 8% return.

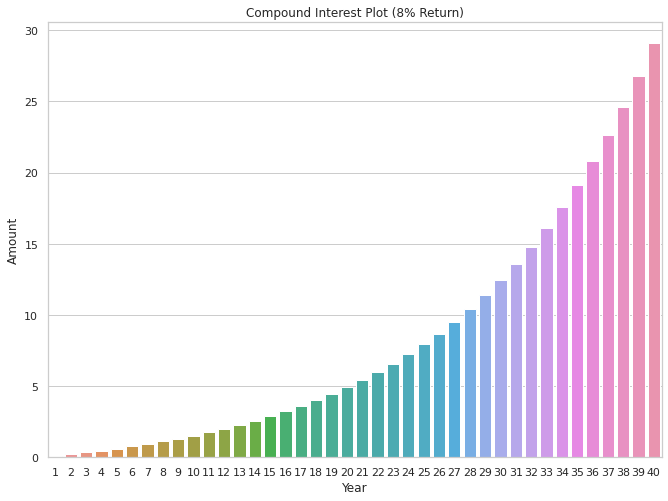

Below is a plot showing an 8% return with the exact same parameters as before.

Saving 10% of your salary with an expected 8% return will result in approximately 29 times your income over 40 years assuming you earn the same in purchasing power over the course of your working years (adjusting for inflation).

That’s a drastic cut to go from 100X to 29X. Let this be a lesson that you should consider carefully what your expected returns will be before selecting one. 8% is conservative for the stock market… at least for the past 40 years but it may not be conservative for the next 40 years. I will continue to use 8% for the rest of this article since it mirrors more practical advice.

Also keep in mind the multiples calculated are based on the starting salary at age 25. If you are looking to retire with a higher income, then adjust the multiple accordingly. For example, if you want to live off 3X your salary at age 25 then divide the final multiple by 3 to get a sense of what you might expect to retire with.

Back to the big question: is saving 10% enough? In a later section I will dig into the 4% rule and how we can get derive an appropriate multiple to target for retiring. It appears, however, that 10% just might work depending on your expectations for growth and how young you get started saving.

How Much Should my Portfolio Return?

Selecting a financial instrument that will return the highest amount of money for the risk you are willing to take can be a complicated task. If your time horizon is long (many years), then the Stock Market is probably a good bet.

Trying to pick specific stocks and sectors is absurdly difficult… most people who try fail. This includes professional money managers. More often than not, you will select a losing fund, stock or any other instrument when compared to those who just invest in the broader Stock Market.

There are many ways to invest in the broader Stock Market. I won’t cover this topic in detail in this article, however a good place to start is to look at a Total Stock Market Index ETF such at VTI (from Vanguard). This fund is often cited and used by FIRE adherents.

Until you know more about investing this is a sure-fire way to go. Many experts also go the Total Stock Market route because they understand the underlying nature of the market is illusive to even the most gifted of market participants.

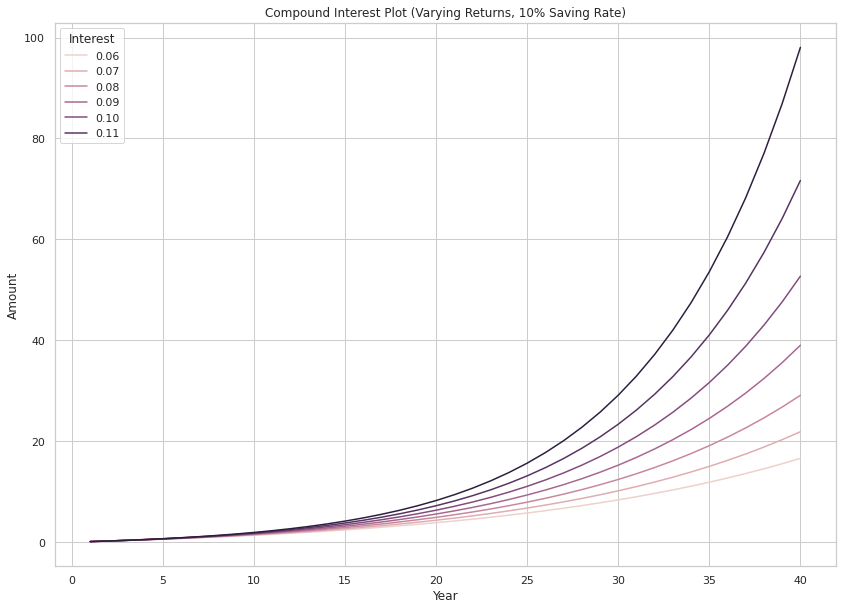

Below is a chart that games out what multiple of your income you would have over a period of 40 years with varying levels of expected interest (from 6% to 12%). The results show that you can expect between 18 and almost 100 times your income if you saved 10% of your income each year for 40 years.

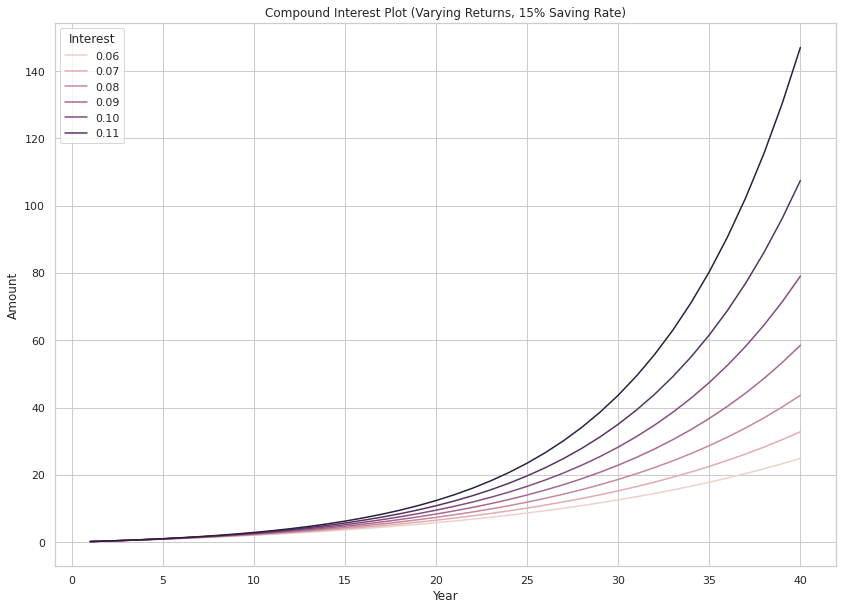

But what if you saved 15%? I got a chart for that! Below you will see the exact same chart as above except the plot shows various expected return rates over 40 years with the saver setting aside 15% of their income.

By increasing your savings to 15% of your income you can increase the range of multiples to about 22 to 145! Can you imagine having 145 times your salary saved up for retirement? This is the power of compounding interest. It pays to start early… even if you can only save just a little at the outset.

Judging from the plot above, saving 15% of your income and expecting a much more reasonable return of 8% yields a final balance of almost 60 times your initial income. This means that you could roughly expect to live off (60/25) 2.4 times your initial salary per year during retirement using the 4% rule… details below. Remember, this is assuming that your income has kept up with inflation which is likely… most folks make considerably more as their career advances.

The 4% Rule for Retiring

The 4% rule is VERY SIMPLE. It states that if you only withdraw 4% of your retirement funds per year while in retirement then you should not run out of money for at least 30 years.

The calculations used to derive this rule of thumb were done in the 1990s and with very conservative assumptions. That said, it’s a good yardstick to measure your expected outcome.

If you can safely withdraw 4% in any given year, that would imply you would need 25X your withdrawal rate stored up. (Math Geeks: 1/.04 = 25). Using our 10% savings calculation above, even an expected return of 8% resulted in a value of 29X at the end of the 40-year period. Thus, saving 10% of your income is enough… if you can retire on the original annual income.

If you want to live a more exciting retirement, then bumping up the savings amount will help…. But saving 10% will ensure that you will not be destitute and can likely live comfortably.

A Word on Taxes

So far, I have ignored taxes. The calculations above will work out perfectly if all of your retirement savings are inside a ROTH type account (e.g. ROTH IRA, ROTH 401k) and thus the amount of taxes owed will be 0 (assuming the requirements are met).

Trying to game out what you will pay in taxes in the future can be quite fruitless depending on where you live and how much money you make. Thank your politicians for this insight.

Something I do suggest is to calculate your future tax basis by looking at what you pay now. Take the amount of money you pay in federal and state taxes, add it up, and subtract that from your final 4% safe withdrawal rate. The resulting amount will be what you can spend.

Using today’s tax situation to guess the future will give you an ESTIMATE of what you might pay in taxes during retirement. This is assuming that you will pay approximately the amount of taxes on capital gains as you are paying in payroll taxes. This is a wild guess… tax laws are changing yearly, and you WILL need to update this assumption frequently.

Updating Your Savings Goals

Updating your savings target should be at least an annual occurrence. As mentioned already, things change such as tax laws, expected returns on investments, and even how much you are making annually.

Changes in expectations for retirement also change. Perhaps you become more accustomed to a specific lifestyle that costs more… this will require an update to how much you are saving. Perhaps you develop a chronic health condition that may increase medical expenses. Or perhaps you receive an inheritance lowering your savings needs.

Whatever life throws at you, be warned that it will change how you might prepare for retirement.

Look at your assumptions, savings rate, and expected safe withdrawal rate at least yearly. Going through this thought process each year will allow you to make adjustments, catch errors and fine tune your strategy so that you can achieve ultimate success.

It’s Never Too Late

If you are reading this having crossed several age barriers don’t fret! It’s never too late to start saving… but don’t wait until tomorrow. Do something about your future RIGHT NOW. If you are 50, and you want to retire in 15 years it may still be possible. But it won’t be if you don’t do anything about it.

Yes, if you are starting the savings game later in life you will need to save a larger share of your income.

But this amount will only get larger each and every year you delay your savings program. Look at the chart below. If you save 1/3 of your income each year starting at the age of 45 and plan to retire at 65 then this is the multiple of your income that you will have saved up assuming an 8% rate of return.

By the time retirement rolls around you can still multiply your current income by 16. That’s no small feat!

Would it have been better if you would have started earlier? Absolutely! But it can be worse… much worse.

The $1 Dollar Challenge

Do yourself a massive favor: Open a new browser tab, go to vanguard.com and open a ROTH IRA and deposit $1. That’s it. I don’t receive any type of commission (check the link… there is nothing fancy about it).

If you have access to a ROTH 401k or 401k with matching perks at work, then email HR right now and find out how to get it going. Right now! With 401k’s you are not allowed to set a dollar amount (this is thanks to Congress BTW), so you will need to set a percentage set aside from your paycheck. Select 1%. That’s it.

Once you have started saving $1 or 1% the hard part is done. Your account is set up. All you must do in the future is just toggle a single number (preferably upward) to start doing some serious savings.

To get on the right glide path determine what your expected growth rate is (8% is a good number for the stock market) and how much you will need monthly during retirement. Use a compound growth calculator that uses monthly contributions, and you should be able to set your first annual savings goal.

Concluding Thoughts

How much should you save for retirement? 25 times your expected annual budget during retirement (after taxes). That’s it. How do you get there? Make an assumption on your annual growth rate and how much of your income per month you are going to save. Voila… that’s it.

Calculating how much you should save is easy. The formulas can be intimidating, but there are numerous calculators out there that will cut to the chase (including my Python Code for Calculating Compound Interest with Monthly Contributions that can be easily modified to suit your needs).

The hard part is walking the walk. Putting your savings on autopilot (e.g., removing yourself from the savings equation) and having an emergency savings are two key strategies to keep you walking the straight and narrow.

I hope you enjoyed this article. Since I retired at the age of 34, I have come to absolutely love writing this blog. My articles are not always perfect so please feel free to add any commentary both positive or negative down below!

Financial Warning

As a reminder: I write this blog for entertainment purposes only. Many assumptions were made in this article and probably some gaffs too… if you are seriously interested in this topic then you should hire a Financial Advisor that has a legal requirement to have your interests at the forefront… in other words they should have a fiduciary responsibility. That person is not me. Please do your own research and do not invest or make financial decision based on what you have read here.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.