‘Rich Dad’ Author Predicts Market Crash: Should I Listen?

Table of Contents

The author of the wildly popular personal finance book, ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has been on a tear lately claiming that October 2021 would bring the ‘biggest crash in world history.’ But should you listen to him? Or has he taken a step too far into the deep end?

In this article I will look at Robert Kiyosaki’s current claims for market disruption and try to see if they are warranted.

Also, I’ll look at some of his previous prognostications and how his recommendations panned out. Currently, he recommends buying Bitcoin and Gold which have had interesting performances during recent market events.

Generally, long term investors don’t concern themselves with daily, monthly, or even yearly fluctuations in market prices but perhaps Kiyosaki is on to something.

HOUSE of CARDs

Back at the end of September 2021, Kiyosaki tweeted that the ‘HOUSE of CARDs,’ was, ‘coming down.’

HOUSE of CARDs coming down. Real estate crashing with stock market. China’s Evergrande Group cannot pay. Valuation of properties fake. Will real estate crash spread to US? Yes. Great stock and real estate opportunities coming for smart investors. Disaster for foolish investors

— therealkiyosaki (@theRealKiyosaki) September 22, 2021

He was predicting a stock market crash caused by plummeting real estate values in China. He was further predicting that the possible crash in China would cause a contagion that would spread to the United States and cause the financial world to fall apart.

But what is he talking about? Whey would Chinese real estate affect homes and businesses in the United States?

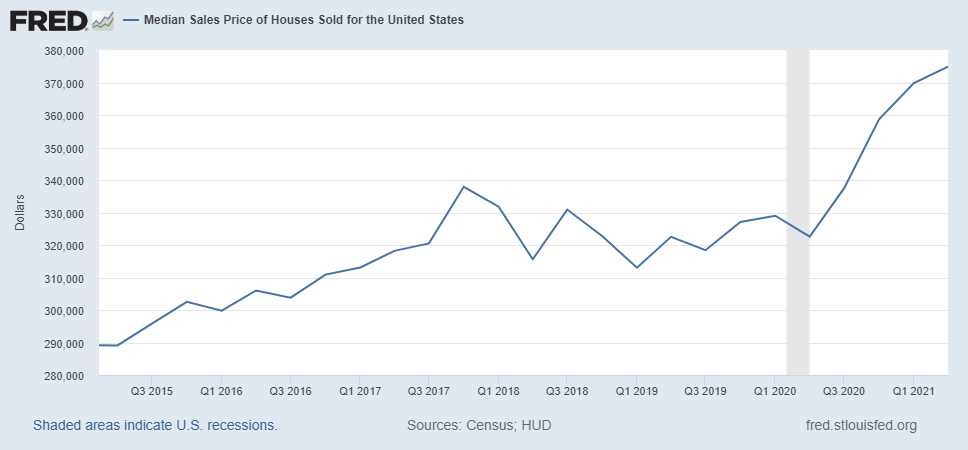

Since the end of the pandemic in 2020, real estate prices have indeed gone up significantly in the U.S. According to Federal Reserve Bank of St. Louis, also known as ‘FRED,’ the median sales price of houses sold in the United States has increased from $329,000 in Q1 2020 to $374,900 in Q2 2021.

That’s a 14% increase in little over a year. Many other indicators also suggest that home prices have risen even further in recent quarters not yet reported compounding the drastic increase.

Since his initial tweet, the only other broad market crash predicted by Kiyosaki was on September 28th, 2021, where he stated ‘West Nile disease shutting down economy.’

So, what the heck is going on? At the time of writing this article, most of October is over. The West Nile virus hasn’t even made a blip on the news and Kiyosaki has remained mum on why the market hasn’t plummeted. What exactly is Kiyosaki recommending we do in the case his predictions come true?

Gold and Bitcoin

Kiyosaki wants you to buy Bitcoin and Gold of course! This could have been guessed by many readers. Just about every doomsayer out there recommends buying these two assets in the case of market calamity. Kiyosaki is no different. Their track performance, however, is not what you would expect given how loud these folks recommend it.

The interesting thing about recommending Gold and Bitcoin in today’s age is that we have some hard data on how both perform during a recent market crisis available to us.

March of 2021 was no cake walk. Investors were scared and the market plunged fast due to concerns about a looming pandemic. How did Bitcoin and Gold perform during the height of fear when the Stock Market tanked?

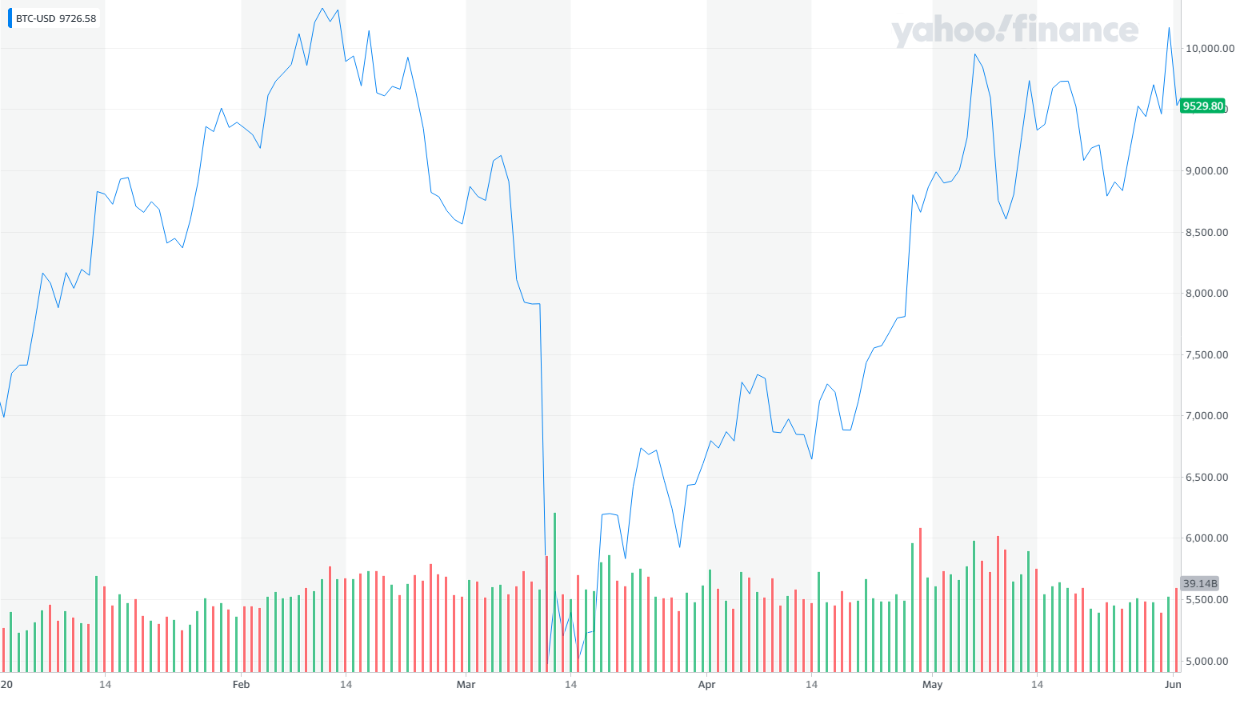

Below is a chart of how Bitcoin performed from be the beginning of 2020 to June of 2020. Note the sharp plunge in March.

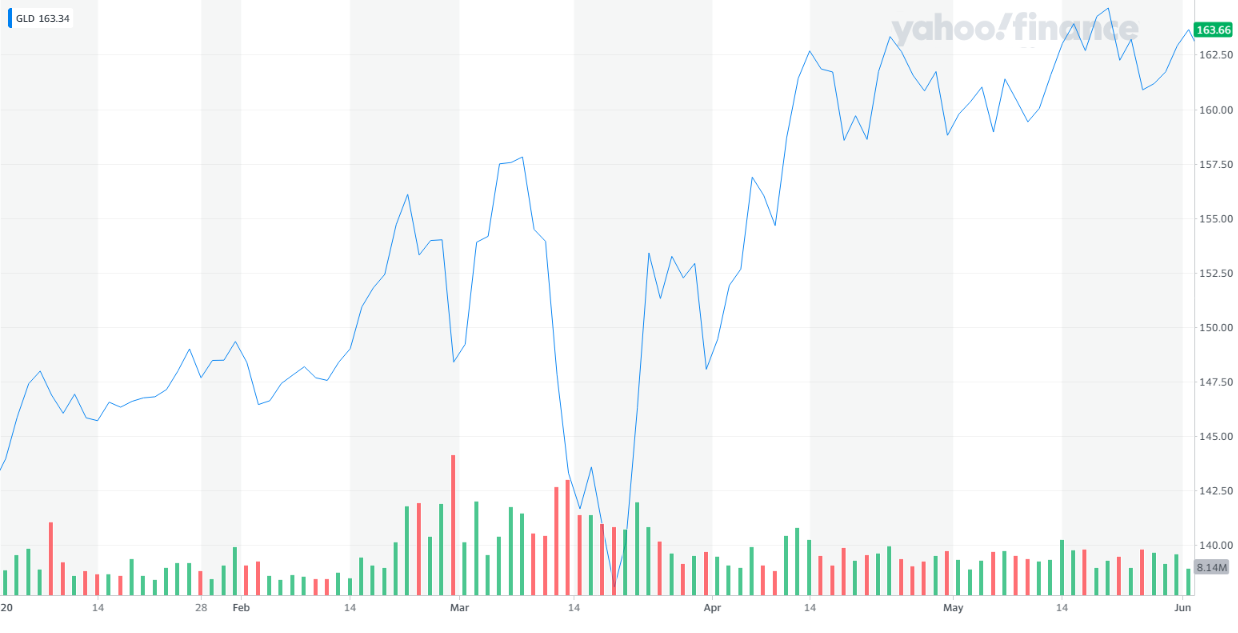

The big take away from the chart is that during a market crash, Bitcoin crashes as well. Check. Now let’s see how gold did. I plotted the ETF ‘GLD’ as a proxy for the performance of Gold for the same period as Bitcoin.

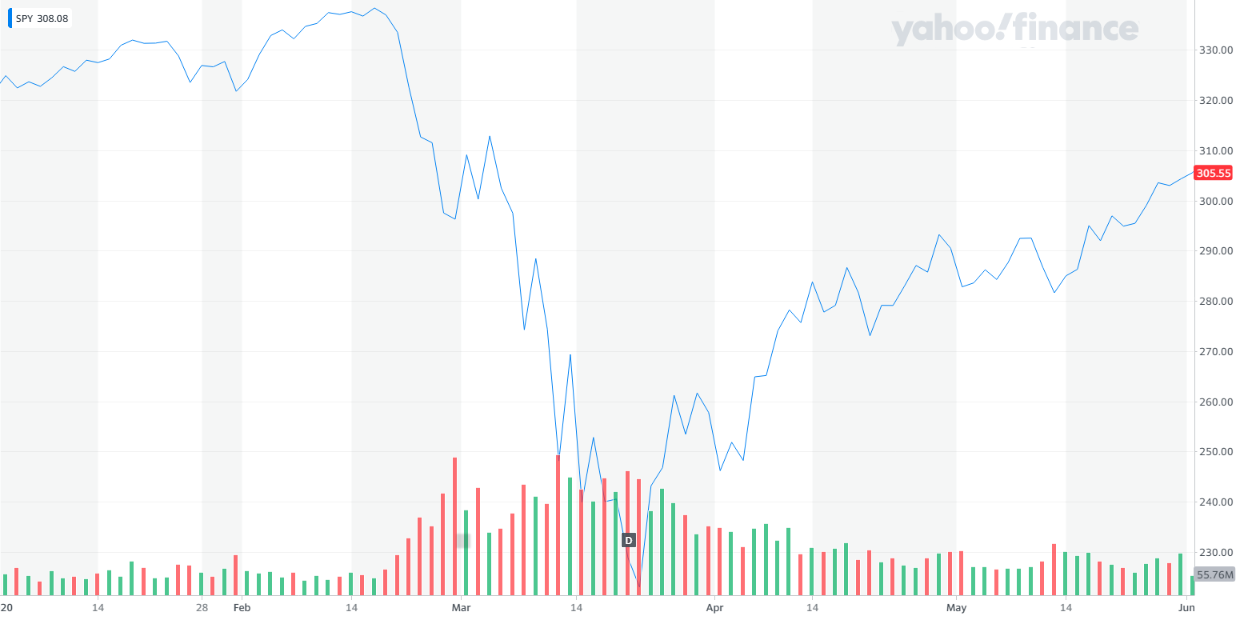

The same thing is obvserved. When the market tanked in March it took gold with it… although the drawdown is not quite as severe on a percentage basis. Below is a chart of the S&P 500 via the ETF SPY.

Clearly, as expected, the S&P 500 down went down at the same time as the other asset classes.

A few things can be noted when comparing all three charts:

- Bitcoin did recover its price after a few months.

- Gold recovered more than its initial price.

- SPY started a recovery but didn’t quite make it all the back to its starting point.

Now each of these snapshots are a small window into their overall performance during a crisis, however, all 3 did plummet at the sign of overall market weakness.

So when it comes to looking at Kiyosaki’s advice to buy Bitcoin in anticipation of a massive market crash I call ‘bunk!’

If a market crash does indeed happen, you can fully expect your holdings of gold and bitcoin to go right down with your regular equities. When people panic, they want to be holding one thing… and one thing only: the United States Dollar. They sell their other holdings and move to cash.

But that’s the real insight into Kiyosaki’s advice… he doesn’t believe in the U.S. Dollar. He has ranted for years that the Federal Reserve, which controls the Greenback, is a fraud. But if the Federal Reserve is a fraud and the U.S. dollar can’t be trusted then where do we go from there?

According to Kiyosaki, you’d buy Bitcoin.

Kiyosaki’s Other Prediction

The 2008 Financial Crisis

According to a news release published by the ‘The Rich Dad Company,’ back in 2012, “Robert Kyosaki correctly predicted the looming retirement crisis.” The reader is left to assume that Kyosaki predicted the 2008 market crash all the way back in 2002. But that’s not successful in my book.

If you sold your stocks and bought gold in 2002 in anticipation of the 2008 financial crisis then you would have lost big time. Yes, you may have missed the crash, but you would have also missed the run-up. You would have had to wait 6 years… would you have had the patience? Would you have given up the strategy 3, 4 or 5 years down the road only to buy at the top and experience the market crash all the same?

Predicting a market crash that will come some time in the future is easy… there is always a market crash somewhere off in the distance. Trying to time it precisely in an attempt to come out ahead financially is pointless.

The market crashes periodically. It will crash in the future. Probably in a few years. Maybe tomorrow. Staying out of the Stock Market because it might crash is ludicrous… it’s the nature of the beast. So why is Kyosaki so gung-ho about trying people convince people to buy Bitcoin and Gold?

Bitcoin’s Limited Supply

Bitcoin, a cryptocurrency engineered with a certain set of rules, has a limited number of coins that can be ‘mined.’ Only 21,000,000 can supposedly ever exist. This means that if you own a Bitcoin or even a piece of a Bitcoin that you own something that has a limited supply.

The more that something in demand something is that has a limited supply the more people will pay for it. In other words, the price goes up when more people want to buy it.

We know that Robert Kyosaki has recommend Bitcoin, and there are even reports that he has been ‘hoarding bitcoin, gold, and silver.’ Thus, Kyosaki stands to benefit by encouraging others to buy Bitcoin even if the market doesn’t crash. After all, if more people want what he has then what he has will be worth more.

That’s right. Even if Kyosaki can convince a single person to buy Bitcoin it could elevate the price of his current holdings. Kyosaki has an incentive to rile people up to get them to buy an asset he advertises he owns. He only wins… even if the market goes up.

In fact, Kyosaki would likely benefit more if the market does go up. Just look at the charts above… Bitcoin performs well when the market does well. Observing his actions combined with available past data suggests that he is positioned for a Bull Market… which is quite the opposite of what he is predicting.

Why else would someone who is potentially a Billionaire concerned with warning the masses about some market calamity… for a second time in 20 years at that?

Keep the Faith

Perhaps there is another way to move forward in a market that inevitably crashes periodically. Maybe we just diversify our holdings and do nothing from there. Markets go down, but they also go up. A long-term history of just about any market suggests that prices always go up over the long term.

Thus, buying some cryptocurrency or gold is not a bad thing… even if it may explicitly benefit the controversial author. But do so in moderation. Set aside 5% or 10% of your portfolio to buy some Bitcoin, but don’t expose yourself too much.

At the end of the day, the broader your holdings are the less you need to worry about buying and selling this and that to prevent a disaster. Over the long term, many of the stocks you own will go to 0… many will go to the moon. But on average they will rise consistently.

Concluding Thoughts

Investors with large social media audiences can be highly incentivized to hype their followers up around specific assets. When it comes to Bitcoin, a cryptocurrency with a limited supply, the rewards can be quite handsome. That said, market crashes due happen… regularly.

Thus, as Robert Kyosaki has been proclaiming, you should prepare for a market crash.

Your preparation should include diversifying your portfolio and training yourself not to make emotional decisions. Don’t anticipate market crashes… even those who claim to be successful at such things can be 6 or more years early negating any type of financial benefit.

Warning and Disclaimer

This is a reminder that I write this blog for fun.

The information provided should not be considered advice and you are responsible for doing your own research. As I have highlighted in this article, you shouldn’t trust people, even rich famous people, on the internet to give you smart investing advice. In fact, it can be very dangerous.

Where can you get advice? Try a Financial Advisor. I have written an article on how to choose an Advisor… it’s not hard but you will always want to make sure that they legally have your best interests in mind.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.