Compound Annual Growth Rate Formula

Table of Contents

When trying to understand how have investments have performed, many turn to the average annual return to get a sense of how they did. But this is a poor way to quantify your investment performance.

To get an accurate measure of performance you should calculate the Compound Annual Growth Rate, also known simply as the CAGR. The CAGR will give you a number that fully reveals the performance of whatever you are measuring.

By comparing the CAGR of your portfolio against a benchmark portfolio or index you should be able to get a sense of how your investments fared on a relative basis.

CAGR Formula

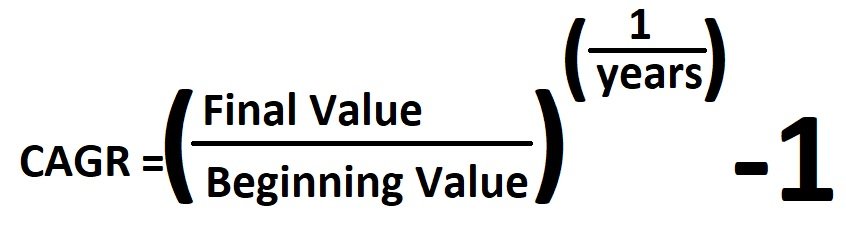

The following formula for the Compound Annual Growth Rate is simple.

Only the beginning value, final value and number of years between the values are needed. CAGR is not a forward looking metric. As you can tell, CAGR is a tool to measure past performance.

When to Use the CAGR Formula

As mentioned above, CAGR should be used when trying to evaluate the performance of an investment over time. The formula can ignore the fluctuations of yearly performance metrics such as average annual return and provide an accurate figure for how your investment has grown.

If you are looking for a way to project into the future, then just use the Compound Interest Calculator. Make an assumption on what type of CAGR you are expecting in the future. This result will lead you to the value of the rate (a.k.a. ‘interest rate’) you should use.

How to Use the CAGR Formula

In order to use the formula, you must know the beginning and final values of your investment. If you invested $10,000 and now have $20,000 these would be the numbers you would use. If 5 years have passed between your initial entry into the investment, then the value for years would be 5.

Plugging all that information in the formula above you would have the following:

CAGR = ($20,000/$10,000)^(1/5) -1

= (1/2)^(1/5) -1

= 1.149 – 1

= 0.149

= 14.9%

Thus, your Compound Annual Growth Rate after investing $10,000 for 5 years with a final value of $20,000 would be 14.9%.

Why Average Annual Return is Misleading

The Average Annual Return, or AAR is often what is cited when given information about how a fund has performed. It takes the return for each year and averages out the results. But this metric is misleading. It should never be used for investment performance.

Let’s assume you invested $10,000 for 2 years. At the end of 2 years, you have $10,000. Using the CAGR formula, your return would be 0%.

Using AAR, we would need to know the individual performance of each year to make a calculation. Assume in this case that the fund made 100% in the first year but then lost 50% the following year. This would result in having the same starting amount. After year 1 you would have $20,000 but after year 2 you would be back down to $10,000.

Knowing the rates of return for each year, 100% and -50% we are left with an Average Annual Return of 25%. Sounds pretty good, huh? Earning 25% per year on average should surely mean you would have more than you started with! But not in this case… therefore AAR is a terrible and misleading way to measure investment returns.

Summary

The CAGR is a great way to measure your investment’s performance. It’s simple and doesn’t lead to the same pitfalls that are observed when calculating the Average Annual Return.

Using CAGR you can also get a feel of how funds, indexes or other benchmarks may be performing when compared to your own. By removing the effect of volatility, you can get a sense of how the long-term performance of a specific investment has grown (or not grown!).

Do Your Research

I write this blog as an expression of my opinion. No part of this article should be considered investment advice. You should do your own research and hire the appropriate Financial Advisor(s) to help with any decisions that may impact your money.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.