How Traveling in an RV for a Year Changed my Outlook on Personal Finance

Table of Contents

During the height of the first wave of the pandemic my wife started playing a video on YouTube about a family that sold everything and moved into an RV to start a new life. Little did I know at the time that 2 months later our young family of 4 would be doing the same thing. What would also change would be my entire outlook on our finances. As a self-proclaimed retirement guru and budget hawk, I had never considered a life where I didn’t work in career for 30 or 40 years before retiring. Selling everything and moving into an RV helped shift my perspective a bit… well… a lot.

Old Life, Old Views on Personal Finance

Up until the pandemic, my wife and I had built a comfortable life for ourselves. We were both working professionals with 2 young kids and a spoiled dog. We had managed to save a respectable amount for retirement and convinced a bank to give us a mortgage for a beautiful home in the suburbs. Our cars were paid off and we never held an account balance on our credit cards. On paper, it sounded like we were on the financial road to success. What we would find out, however, is that we were doing it all wrong.

Despite the rosy cover story, what I didn’t mention, but what you could probably assume was that my wife and I both worked 9-5 jobs inside of ill lit and poorly configured cubicles of desperation. Our well-paying jobs required us to trade our life force in return for a constant drip-drip of a money.

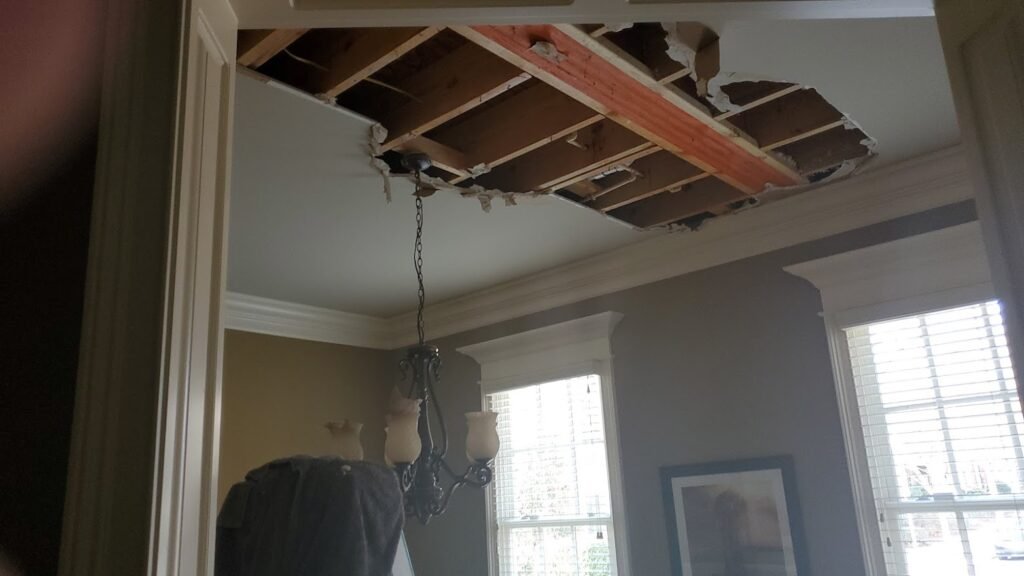

We had excellent PTO packages, however, with 4 weeks out of every 52-week period we were offered the high privilege of doing anything other than locking ourselves into our padded boxes. What we found over time is that we spent this precious time looking after our kids during sick days or watching plumbers, electricians or some other tradesmen fix something catastrophic that went wrong in our house (our oldest daughter once left the sink on in a second-floor bathroom… with the drain closed).

What happens when you leave the upstairs faucet running…

We saved our money though. Month in and month out we diligently socked away a significant amount of our earnings in the hopes that we could achieve escape velocity from our work lives. In between emails at work, I would envision a future filled with catnaps interrupted only by the refreshing sounds of waves hitting rocks.

Like many folks, we planned to save as much as we could until we couldn’t anymore… hoping to make it to the 59-and-a-half-year-old finish line that would mark a life of financial success. We were successful financially… we were not successful at life.

A Pandemic Inspired Shift in Attitude

Once the pandemic started changing ordinary life, my wife and I knew that we had to make a more fundamental change. The shift from working in a cubicle to working from home seemed like it would change the landscape of our lives for the better. In reality, it just brought the drudgery home. Instead of having to slog away at a repetitive task in the quiet solitude afforded by an entire building full of depressed and worn-down souls, we had to do it at home. The work itself was the problem. Our noble goal of financial freedom seemed as if it was in jeopardy.

With a little insight, however, the pandemic did help us on towards a path of freedom from old ideas. On a particularly warm April evening, my wife started playing a YouTube video about a family that had sold their house and moved into an RV. They had traded in their old life for something a bit more bizarre. The YouTube channel in question was called, “Keep Your Daydream,” or “KYD” for short. A bit corny for sure, but it certainly hit a chord given the pandemic landscape.

As we watched, episode after episode, it became clear that this was something that could help us explore the world. After all, my wife and I both worked from home. Our kids’ school had transitioned to online learning. We could hypothetically hit the road in an RV and continue our digital lives while being in a new place every couple of days or so. The logic seemed infallible… we bought an RV a week later. House sold… 4 weeks later. … and we were off!

A Job Lost, a Truth Overturned

After buying an RV and selling our house, life seemed pretty good… and it was. Every Sunday we would move to a new location and then hunker down for the week to work and go to school. We were able to hit the beaches in Florida and hike the Appalachian Mountains all the while continuing with our old financial habits (both earning and saving). But, one day almost 6 months later, I lost my job. I had been a government contractor and the contract was unexpectedly awarded to a competitor. I was no longer able to travel, work and play so it was time to go back to the old life.

The thought, however, of returning to a life in a cubicle was sour. I found it difficult to consider that I would have to give up my new life for an old life once discarded… but our financial dreams were at stake, so I swallowed my pride. I applied to as many remote jobs as possible, but I also applied to a few in person jobs in Florida as well just in case. After not hearing a peep from a single remote job application, I was inundated with interview requests for jobs that needed to be done in person… not surprising given the infectious nature of COVID. Thus, I found a suitable position and headed back to work. Given we were tied to a location due to my new job, we also ditched the RV and moved into a new home as well.

Although now back to work and bringing back home a steady paycheck I felt the urge to escape almost immediately. This new job was just a tad worse than the last one: instead of having my own cubicle I had to share my new space. Instead of being able to suffer my sentence as I saw fit, I was under constant surveillance. I felt as if I had taken one bad situation and traded it for a worse situation. It became clear that I needed to change my outlook more fundamentally. Temporarily working remotely and living in an RV was quite the experience, but the end of the road looked exactly where I had started. It was time to be a bit more intentional about where I would head next.

A New Financial Goal, a New Life

This time, instead of jumping headfirst into a lifestyle change that matched our financial goals, my wife and I decided to look at our financial future and see if it jived with how we wanted to live. Many give the advice to do what you love when it comes to work… but that advice is rarely actionable. Some also say that if you can find something that you are willing to work at even through retirement, it may be just as good. We went with the latter opinion.

In the article, ‘Why I Quit my Job to Start a Blog,‘ I go over several qualities I wanted this new ‘work’ to look like. I wanted it to be flexible… both in time committed and where I could execute my tasks. I felt these qualities would make my job bearable now and into the future. I believed that if I found a line of work that I could reasonably commit to working even during retirement then I could lower my savings requirements. Thus, the attempt to become a blogger was born and my financial windfall necessary to escape a work life I hated plummeted drastically. I would no longer be working exclusively to stop working.

Frankly, not a lot of preparation was put into starting a blog. I knew the basics. The more important part was I knew that it would fit my lifestyle and financial goals if I worked at it. I knew I had the loving support of my family and that if I gave it all my effort that I would likely succeed. I also knew, from experience while travelling in the RV, that if writing a blog didn’t pan out then I could always just head back to the cubicle. (I did place a few obstacles to my return that I mention in the article above to keep me focused).

Trading Safety for… Living Life

What was most important in choosing my new profession and adjusting my financial goals was realizing that if you must work a lifetime in the hope that you need to escape your day-to-day life then you are not truly living. You have mixed something up and need to sit down and reassess where you are going. If your financial goals insist that you keep trading your life force for something that does not pay off immediately in terms of satisfaction or happiness, then it’s time to let go of what you know and learn something else.

If you are stuck in this type of a rut, like I was, then realize it for what it is: the trading of safety for the unknown. By quitting your job, by lowering your retirement hopes; by doing today what you did yesterday you are just trying to walk the narrow plank of the safe known. Add a little bit of risk, a little bit of fear of the unknown, and you will find that great things await. The greater risk you take to move outside of your defined box the greater the chance for something new and exciting to happen. If you invest in your happiness now, it will pay off in the future… even if your account balance is lower.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.