Robo-Advisors: Everything You Need to Know

Table of Contents

By now, many people have probably heard the term, “Robo-Advisor,” thrown around on T.V. or amongst co-workers. But what exactly is a Robo-Advisor and how could it fit into your own portfolio of investments? In this article, we will seek to help shed light on what a Robo-Advisor is, what the pros and cons are, how much they cost, if it makes sense for you, and finally where you can find a reputable Robo-Advisor.

What is a Robo-Advisor?

Very simply, a Robo-Advisor is an investment product where the buying and selling of its underlying securities are done with an automated algorithm or ‘Robot.’

The end goal of a Robo-Advisor is to provide a complete solution for an investor that is hands-off allowing the average person to ‘invest,’ while getting better than average performance. It should be noted that whether Robo-Advisors are actually successful at providing better performance can be difficult to determine.

Robo-Advisors are a relatively new offering that has been born from the recent emergence of what is called Fintech. Fintech refers to the integration of sophisticated technology comprised of software that usually relies on some type of Artificial Intelligence, Machine Learning or some other automated technique that seeks to make financial products cheaper and easier to access.

Robo-Advisors can be found in the form of products, such as that offered by Vanguard called Vanguard Digital Advisor, or entire companies such as Betterment or Wealthfront. Usually, the product itself is composed of a group of low-cost Exchange Traded Funds (ETFs). The exact composition of how much of each fund a Robo-Advisor is invested in is the result of the Robo-Advisor’s algorithm.

Ironically, many Robo-Advisors, such as Betterment, are comprised of ETFs from Vanguard since they often have some of the cheapest funds available.

Theoretically, the advantage is that they provide is that they can try and maximize profits for their clients by considering things like taxes and specific market conditions that the average investor can’t or wouldn’t be able to take action on without access to a sophisticated team of financial market experts.

How is Robo-Investing Different from Normal Investing?

Normally, Mom and Pop investors such as you and I either pay an Investment Advisor of some sort to construct and monitor our investment portfolios or we DIY it. Either way, a human is involved. A human makes decisions about what and when stocks, bonds or ETFs end up being purchased or sold.

With a Robo-Advisor, initial parameters like risk tolerance, time horizon or financial objective are selected by the investor as inputs and the rest is taken care of by an algorithm. What spits out the other end is hopefully a better outcome than what could have been achieved with a human at the rudder.

Many firms that sell Robo-Advisor products also make financial advisors available to their clients, but this often requires an additional fee or minimum account size. Still, the specific decisions that are occurring as it relates to buying and selling securities are generally left up to the algorithm.

What are the Benefits of a Robo-Advisor?

There are several benefits when using a Robo-Advisor depending on the type of investor you are. Typically, an investor who prefers a hands-off approach to managing their portfolio will have the most to gain when using these types of products. Here are a few benefits that some Robo-Advisor platforms tout:

Low Fees (Compared to Human Advisors)

Many Robo-Advisors charge around 0.25% of your total Assets Under Management for their services. This amount can vary depending on the service and the account size. This is on top of whatever fee is wrapped in for the financial instruments they use (e.g. ETFs). This total amount may be around 0.35% -0.50%.

In comparison to their human counterparts, that’s cheap. Many human advisors charge 1% for their services… on top of any other fees for the funds they choose. If you are deciding between a robot and a human (not DIY), then the robot wins hands down.

Various Strategies Based on Risk Tolerance

A big benefit to using a Robo-Advisor is that by filling out a questionnaire, many platforms can deduce an appropriate strategy or algorithm that meets your stated objectives and risk tolerance.

The strategy used for a retirement that is 30+ years away will look very different from one where you are saving for your 6-year old’s not-so-far-away college expenses.

Being able to change your risk tolerance and investment objectives on a whim is also exceptionally easy. Modelling out your expected returns based on the risk taken on is usually part of the software suite made available. Being able to find a custom solution that fits your life at any time of the day, every day of the week, is a definite big win.

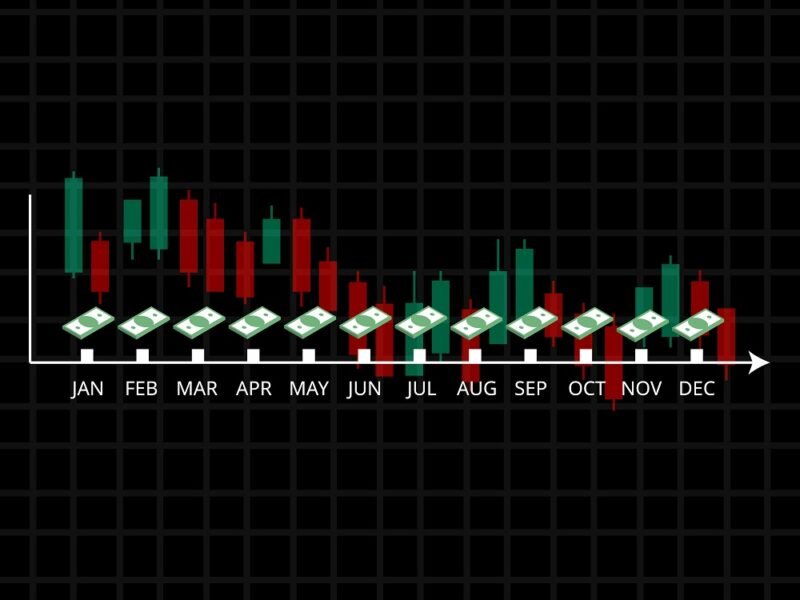

Taking Advantage of Complex Tax Situations

Tax laws regarding the Stock Market and Securities in general are difficult to understand and even worse to implement.

Tax laws regarding the Stock Market and Securities in general are difficult to understand and even worse to implement.Knowing how selling stocks or ETFs in your portfolio may actually be advantageous to your total financial position despite a loss in your portfolio is downright impossible for an amateur. Robo-Advisors fix this with little or no effort on your part (with some exceptions noted below).

Tax loss harvesting can mean lowering your eventual tax basis by thousands of dollars per year. Ideally, this benefit is what pays for the higher commissions charged (versus a DIY approach). Over several years, the benefit of collecting on tax loss harvesting could compound to a tremendously large number… just make sure you reinvest your savings at tax time.

Great Entry into the Stock Market with ZERO Knowledge

If you don’t know anything about stocks and even less about bonds then answering a questionnaire and depositing your money at a firm with a Robo-Advisor could be an absolute game changer.

The ability to go from non-investor to intelligently invested in a fund that has taxes accounted for is like going from pee-wee football to the NFL in a split second. Even if you are the 3rd String QB for the worst team in the league, you are in the NFL… that’s all that matters.

No or Small Account Minimum

Generally, Robo-Advisers operate the same whether you have $1 or $1,000,000 invested. The size of the account is all relative and platforms allow no or small account balance minimums.

This can’t be said for their human counter parts.

It takes a quite a bit of time to understand a person or family’s investment objectives and risk tolerance. When most human advisors only collect a 1% fee, it can be quite a challenge to offer good financial advice to those without substantial account sizes.

What are the Cons of a Robo-Advisor?

There are certainly cons to using Robo-Advisors, but often they come as a matter of perspective. Determining, introspectively, what type of control you are looking to have when it comes to designing your portfolio is key. Here are a few cons that likely cut across all investor personality types:

High Fees (Compared to DIY ETFs)

Compared to just selecting a Total Stock Market Index fund, Robo-Advisors are actually quite expensive. In fact, many times more expensive. The expense ratio for Vanguard’s ETF tracking the entire stock market (VTI) is only 0.03%.

Since, as noted above, you can expect a Robo-Advisor to set you back about 0.25%, the robot appears to charge over 800% as much in fees. If you are comparing a robot to what a simple broad based index fund charges for fees, then the robot loses… by a massive margin.

It’s a robot… Empathy Does Not Exist

I have often heard that one of the biggest things a human financial advisor can do is to talk to their clients, convincing them to hold their investments, during major downturns in the market. Buying high and selling during a panic is a time-tested way to lose an incredible amount of money.

I have often heard that one of the biggest things a human financial advisor can do is to talk to their clients, convincing them to hold their investments, during major downturns in the market. Buying high and selling during a panic is a time-tested way to lose an incredible amount of money.Having a financial advisor that helps you walk the straight and narrow during emotional peaks and valleys in the market and in our own personal lives is critical for long term success.

A robot does not have that capability (yet). If a 2008 style crash were to happen, would a Robo-Advisor have the relationship and emotional acumen to understand your fears and convince you to keep your portfolio where it’s at? Probably not.

Performance Claims are Confusing at Best

After searching quite heartily, it has been difficult to get a clear gauge of how Robo-Advisors perform. Since each have many funds or strategies that can be slightly different for each customer due to their tax situation, there is not a clear performance metric or even advertised benchmark to compare to.

In my book, this is by far the biggest criticism. It likely will not be possible to determine how you are doing against a benchmark (e.g. the SPY or VTI) until a significant amount of time AFTER you have invested. This black box of expectation makes it difficult to quantify what to plan for. Or, conversely, how things panned out compared to other options.

Tax Strategies May Involve Handing Over Full Financial Holdings

The complex nature of tax law usually applies to all an individual’s holdings at once. Even if they are in different accounts. If you sell an ETF in one brokerage account and also have a Robo-Advisor that is using Tax Harvesting, you may find yourself running afoul of some nasty trading rules.

To account for this, a Robo-Advisor will ask to link to your other brokerage accounts so they can make sure not to interfere with your other investment decisions. Although this may ultimately work, the idea of a sophisticated algorithm having access to ALL my trades is a bit unnerving.

Is using a Robo-Advisor Right for Me?

This is a great question that can only be answered by you. If you are looking for a very simple approach, and your overall investment situation is currently uncomplicated or ‘not spread out,’ then going with a Robo-Advisor could be a great idea. If you don’t care about watching the stock market and don’t find yourself perplexed about what may be going on behind the curtain, then dive right in.

Alternatively, if you have specific concerns about how your money is deployed, particularly during tumultuous market conditions, then going with an automated approach may not fit your investing style. In this case, having someone you can talk to may make sense.

Additionally, there is always the DIY approach. If you enjoy reading and learning about new financial happenings, then you may be able to DIY a bit better. If you are always reading Yahoo Finance or watching CNBC, then a Robo-Advisor may be too boring or hands off an approach.

All this said, with account minimums being virtually $0, it may not hurt to stick a small amount of money into a Robo-Advisor and just seeing how it goes over time. The only drawback to this idea would be that in order to take advantage of tax loss harvesting you may have to cede over some account viewing permissions so the robots don’t make a misstep based on your other holdings.

Who and Where to Get a Robo-Advisor

There are 3 main players in the Robo-Advisor realm. There are many more than these 3, but for your initial research you should consider looking at these first to get an understanding of what a Robo-Advisor product should look like.

- Betterment

- Fees: 0.25%

- Account Minimum: $0

- Tax-Loss Harvesting: Yes

- Wealthfront

- Fees: 0.25%

- Account Minimum: $500

- Tax-Loss Harvesting: Yes

- Vanguard Digital Advisor

- Fees: 0.20%

- Account Minimum: $3,000

- Tax-Loss Harvesting: No

As you can tell from above, each has their strengths. Large account holders in tax-advantaged accounts should probably go with Vanguard. Very small account holders concerned with taxes in mind should consider Betterment or Wealthfront. Each company also has other offerings that try and differentiate their products but none of them have good past performance metrics to make a solid comparison outside of what is listed above.

Concluding Thoughts – An Objective Look

Hopefully throughout this article you have gotten a better idea about what a Robo-Advisor is and is not. The term is loaded in that implies automated investment portfolio construction without really going into detail. When ultimately deciding to use or not use a Robo-Advisor it is always important to do so with a dash of cynicism.

At the end of the day these products have not been around that long. Although past performance is no indication of future performance, past performance may be a good indicator of technical feasibility. Given these products are in essence machines governed by the software and algorithms that construct their ‘decision making,’ a longer track record of disaster avoidance could go a long way to easing concerns.

That said… be careful. Keep a watchful eye of what is going on. Just because you don’t, “have to monitor” what is going on doesn’t mean that you shouldn’t evaluate your Robo-Advisor’s performance against a benchmark and switch out of it if it no longer feels right.

Although, you should not expect a Robo-Advisor to match or beat a benchmark index ETF such as Vanguard’s Total Stock Market Index ETF (VTI) every single Day or Quarter, it should come close after 1, 2 and 5 years. If not, then the juice may not be worth the squeeze.

Keep in mind that the advertised advantages of some products are their ability to help you limit your tax exposure. This means that to take advantage of the fee that you are paying a Robo-Advisor you better make sure that you are filing your taxes appropriately.

Robo-Advisors could be a decent proposition for slightly beating a broad based stock market index fund over the long term… but no one knows for sure what the future may hold.

Financial Disclaimer

I thoroughly enjoy expressing my opinion on this blog, but remember it is only that.

Do your own research. No part of this blog post or website should be used to make investment decisions.

I do recommend, however, that you seek professional financial advice. You should look for someone that you pay so that they are incentivized. You should look for someone that has a fiduciary responsibility for taking care of your money… so you can sue them if they don’t do what they are supposed to.

Please feel free to email me or put your comments below! I always consider my blog posts a work in progress…

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.

Tax laws regarding the Stock Market and Securities in general are difficult to understand and even worse to implement.

Tax laws regarding the Stock Market and Securities in general are difficult to understand and even worse to implement. I have often heard that one of the biggest things a human financial advisor can do is to talk to their clients, convincing them to hold their investments, during major downturns in the market. Buying high and selling during a panic is a time-tested way to lose an incredible amount of money.

I have often heard that one of the biggest things a human financial advisor can do is to talk to their clients, convincing them to hold their investments, during major downturns in the market. Buying high and selling during a panic is a time-tested way to lose an incredible amount of money.