How Much Should I Spend on a Home

Table of Contents

How much you should spend on a house or home is an incredibly important question that will have an astounding impact on your quality of life. The variables that can impact the amount you should spend can be dynamic, leaving you with moving goal posts.

In this article we will tackle exactly how to calculate what you can afford and ultimately what you should consider on spending for a house or home.

Variables to Consider

First let’s tackle what variables may impact your ability to purchase a home. There are several. Each one can substantially weigh the scales in one way or the other. Balancing each variable is something that you will need to figure out prior to setting a hard budget cap for your home search.

Below is a list with an explanation of each variable that you should understand prior to setting a budget for your new home. Keep in mind that other expenses and factors may need to be added depending on your specific situation.

Interest Rates

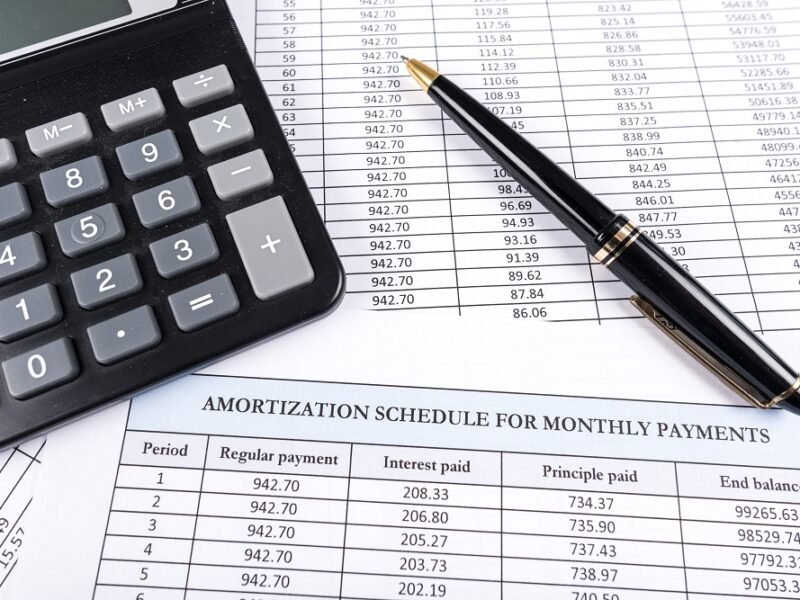

Probably the single biggest factor that will determine the affordability of a specific mortgage outside of the price is the interest rate that a borrower must pay.

Probably the single biggest factor that will determine the affordability of a specific mortgage outside of the price is the interest rate that a borrower must pay.

When buying a home, there are numerous fees and costs that are often rolled into the loan. Then there is an amount of money that the bank or lending institution must make to turn a profit (it is a business after all).

When you combine the cost of fees and the banks interest rate for lending you money the ‘Annual Percentage Rate,’ is the term used to describe the cost of loan to the borrower. This term is also known as the APR.

The APR that you can qualify for is based on the risk of default you present to the lender. Ultimately, the lending institution will raise your interest rate if they think there is a higher chance you won’t make your payments on time or at all. This helps them essentially insure themselves against taking a loss on the transaction.

Your credit score is what is most often used to help determine what type of credit risk you pose. The score is composed of things like the number of years you have been paying on loans, what type of loans you have outstanding, what your revolving credit looks like (credit card use) and recent requests for credit.

FICO Credit Scores (a specific brand of credit score) can range from 300 to 850 with ‘good’ being above 670. The higher your score is the more likely you will ‘qualify’ for a lower interest rate and APR. If you have a bad credit score it may be worth spending time fixing your credit before making the effort to buy a house. The amount of money you could be saving very well might be outrageous.

According to Business Insider, in August of 2021 the difference in APR on a mortgage of a borrower with a credit score of 639 and that of someone with a score of 760 was a little over 1.5%. That doesn’t seem like much, but over the course of a 30-year $300,000 mortgage the cost of having a lower credit score would be $91,800 or about $255 a month.

In other words, find a way to get the best interest rate. Your credit score matters, and you can do things to improve it. Here is a YouTube video on things you can do to increase your credit score so you can buy a house:

Conventional Loan Limits

The next thing you need to consider when determining how much you can afford is the type of loan you are looking to get and what the maximum loan amount is. The US Federal Housing Administration (FHA) sets guidelines on how much a borrower can get without designating their loans as ‘Jumbo Loans.’

Jumbo loans usually have higher interest rates and for 2021 the maximum amount you can borrow without becoming a Jumbo borrower is: $548,250. This number does vary in some areas in the country and can be as high as $822,375 for high-cost areas. Use this web tool from the FHA to determine what the limit is in your area.

VA loans also follow the same FHA limits. If you are looking to borrow over the limit you will then be required to get a Jumbo VA Loan. Any amount over the limit must have a down payment equal to 25% of the difference… this is despite VA loans not generally requiring a down payment.

As an example, if you decide to buy a house for $1,000,000 and the loan limit is $600,000 in your area, you will need to put down $100,000 as a down payment for a Jumbo VA Loan which is 25% of the difference of $400,000. Thus, considering your loan limits can be highly informative when it comes to determining a house hunting ceiling.

Down Payment Requirements

Down payment requirements aren’t just for those who exceed FHA limits for conventional loans.

Many banks will require varying levels of a down payment based off things like your credit score, income, or appraisal of the home. These amounts also may be different for each property you may be considering and may vary from bank to bank.

If you are seeking a Conventional Loan, then you should be looking to put down at least 20% of your purchase price. If you don’t put down 20% then you will have to pay what is called PMI.

PMI, or ‘Private Mortgage Insurance,’ is basically an insurance policy that pays your bank if you don’t pay your mortgage. There is 0 benefit for the borrower… only an expense. You should do everything possible to not pay PMI, and typically just putting 20% down on your loan is all you need to do.

Another down payment cost could be if your new home isn’t appraised for what you offered to pay for it. In this case, you will typically need to pay in cash the difference between what the home is worth and what you offered.

Hopefully, if you have gotten to this point, your offer for the home was contingent on the home appraising for as much as your offer. If you have this contingency, then you should consider asking the seller to lower the purchase price or buy a different home.

Despite what you may read on the internet, paying more for a home than it is worth is never a good idea. Find somewhere else to live. Rent. Go on an expensive vacation until more homes are listed.

Okay, I’m kidding on the last one… but no home is worth more than it is appraised for… Literally! Don’t be highest bidding fool who pays too much because they are too tired, lazy, or impatient to look elsewhere.

Insurance Costs

According to Bankrate, the average cost of Homeowner’s Insurance (not PMI) is about $109 per month on a home that has $250,000 in coverage. This could be very different depending on the type and location of the structure so make sure you get an individual quote from your chosen insurance company.

Now, if you had a mortgage for $250,000 at 3.5% interest your monthly payment would about $1,123. Tacking on another $109 is right at about a 10% increase in what you would have to pay monthly.

Thinking of skipping insurance? Think again. Not only is it a requirement to in order to initiate a loan, the bank will also likely make you pay the insurance premiums to an escrow company just to make sure that you don’t miss a payment.

Taxes

This is a BIG one. Taxes on property can vary widely depending on where you live. If you live in Texas where income taxes don’t exist, get ready to find out where Texas gets its revenue…. Property taxes! For many folks, taxes can rival size of the actual mortgage payment itself.

Where you decide to buy your house can matter at an even more granular level than the state: county, city and school districts can have property taxes that increase from one property to another. Crossing a street into a different neighborhood could mean a different school system and a substantial difference in tax bill.

Working with your real estate agent to learn about how taxes may impact your monthly payment is critical. They will know when you have crossed specific government boundaries that may be beneficial or otherwise.

Also, keep in mind that if you have kids and want a specific school district you may have to pay for that through taxes… private schooling may be competitive if you are flexible.

Here is another quick YouTube video that can spell out exactly what and when to pay property taxes:

HOA or Other Monthly Fees

If you are looking to move into a neighborhood with common areas such as tree rows or swimming pools then Home Ownership Association (HOA) fees will factor into your home buying equation. If you are looking for your home to be in a Condo (such as myself) then Condo Owner Association (COA) fees can be as much as half of your monthly payment!

When you are looking for a home, HOA and COA fees should be spelled out on the information sheet provided by your real estate agent.

Make sure you figure out how much you will have to pay. When you make an offer, make sure you find a way to see if there are any major expenses the HOA / COA is expecting to have to pay for. Some condos, for example, can have a special one assessment that can be in the 10’s of thousands of dollars for each condo unit.

It would be unfortunate to enter into a contract for a home that has a substantial monthly fee and even worse if you purchase the property only to find that a special assessment is about to set you back more than your down payment. Do your research and get everything in writing from the seller.

Retirement Goals

Don’t let whatever amount you are looking to spend on a home affect your ability to retire. The benefits of home ownership do not outweigh your retirement planning. If owning a home outright is part of the plan, make sure it makes sense and doesn’t compromise your ability to maintain or otherwise live in the actual home.

Just because you are looking to eventually retire in the home doesn’t give you license to pay too much.

Even when the home is paid off, an expensive home will subsequently have expensive insurance, taxes and maintenance that must be performed just to make it livable.

Your home ownership goals should be bounded. Once your monthly obligations for housing start creeping into your pre-determined savings goals for retirement you have gone too far. Plan for retirement first. Plan for home ownership second.

Maintenance Costs

According to American Family Insurance, the average monthly maintenance cost for a home is about $170. Keep in mind that this number might be a bit high since it is quoted by an insurance company in the business of insuring appliances, but it is probably a good rule of thumb.

There are plenty of maintenance expenses that you will have to pay for routinely like HVAC filters and lawn care, however, there are larger ones that also come once every few years like replacing your entire HVAC or roof.

In fact, when I bought my last condo, the HVAC failed with 2 weeks of closing. That was a $9,000 ‘maintenance’ cost right there. Besides making sure you have a stout emergency savings account, properly planning to pay for maintenance monthly is a must.

Don’t skimp… a delayed fix due to poor planning can make things worse of the long run. A delayed coat of exterior paint, for example, can cause structural damage.

Renovation Costs

Looking to buy an older home?

Looking to buy an older home?

Perhaps the kitchen needs a refresh, or the interior needs a new floor. When shopping for a home it can be easy to hand wave major fixes and renovation costs as if they are nothing. Prior to establishing a firm purchase budget make sure you have identified how much you are willing to set aside to renovate your chosen home.

If you decide that you don’t want to renovate and that your budget is $0 then act like it. When you tour a home that needs X fix or Y maintenance, make sure you acknowledge that you aren’t likely to fix the issue. Whatever problem exists will continue to exist because you aren’t going to commit the time or money to make it right. That’s okay.

That said, if you are willing to set aside money to complete a renovation make sure its enough. Have a contractor provide a quote PRIOR to making an offer. Build the renovation costs into your offer to the seller and highlight the fact that you will have to undergo further construction to make the space livable as you see it.

Debt to Income Ratio

All the prior sections lead up to this major consideration. Your housing budget will have several one-time costs such as the down payment, expenses to move in, and possibly more set aside for renovation.

However, at the end of the day, you must be able to afford your new home on a monthly basis since this is how you will be expected to pay for it. Your monthly expenses for your new home combined with your other monthly debt obligations compared to your income before taxes is called your debt-to-income ratio.

The 28/36 Rule

The 28/36 Rule states that your monthly mortgage payment shouldn’t exceed 28% of your monthly gross salary. Additionally, your mortgage payment combined with all your other monthly debt payments such as your car loans should not exceed 36% of your gross income.

The 28/36 Rule states that your monthly mortgage payment shouldn’t exceed 28% of your monthly gross salary. Additionally, your mortgage payment combined with all your other monthly debt payments such as your car loans should not exceed 36% of your gross income.

Thus, if you make $120,000 a year which is $10,000 a month then you shouldn’t spend more than $2,800 a month on a mortgage (along with insurance, HOA/COA fees, Taxes, etc.) and not more than $3,600 when rolled in with the rest of your debt.

In my opinion, the 28/36 Rule is VERY LAX.

Dave Ramsey, the well-known personal finance guru, recommends to his followers to not exceed 25% of their income after taxes. Thus, as in the above example, if you make $10,000 a month before taxes but only take home $8,000 you would only be able to afford a home that costs you $2,000 a month. That is much less than the 28/36 rule

In my own life, I have never been comfortable with paying more than 15% of my post tax income. That’s conservative. You may find other smaller lenders who can offer you mortgages with a debt-to-income ratio of up to 43% but this is a very bad idea.

How Much Can I Afford on a Mortgage?

It’s reasonable to spend between 10% and 30% of your after-tax income on housing expenses. Any more than that and you will likely find that either your quality of life or retirement savings will be impacted.

Yes, lenders will give you more. Yes, the government says you can afford more. But there is more to life than working and paying for a home. Paying too much for your next home is not worth whatever elusive benefits that you may think you will be getting.

Final Thoughts

How much should you spend on a house? Not more than you can comfortably afford each month once you include any HOA fees, Insurance Premiums, Renovation Costs and have paid your down payment for the specific type of loan you have selected. You should make sure that you qualify for the best interest rate and look to keep your overall expenses for home ownership below 25% of your net monthly income… hopefully less.

With all that said, I know that buying a home can be a very emotional situation. Don’t let your immediate feelings sabotage your long-term financial goals. There is no point being stressed day in a day out about your finances because you spent 20% more than you had planned so you could have the ‘perfect house’ that you will ‘live in forever.’

There is no perfect home, and you certainly won’t live in the one you buy now forever… dream bigger. Buy a home that fits your budget today so that you can live a comfortable life later as well.

I hope you enjoyed this article! If you have any thoughts on this topic, please feel free to drop a line below in the comments section.

Disclosure

I thoroughly enjoy writing posts for this blog, but you should understand that the content I write should be considered an opinion only.

Please seek out financial advisors that have a fiduciary responsibility to provide you with the best advice possible. Buying a house or home can be a very rewarding experience and financial transaction if you do your research and find the right experts.

Guy Money

As a formally trained Data Scientist I find excitement in writing about Personal Finance and how to view it through a lens filtered by data. I am excited about helping others build financial moats while at the same time helping to make the world a more livable and friendly place.